What is Automatic Account Determination?

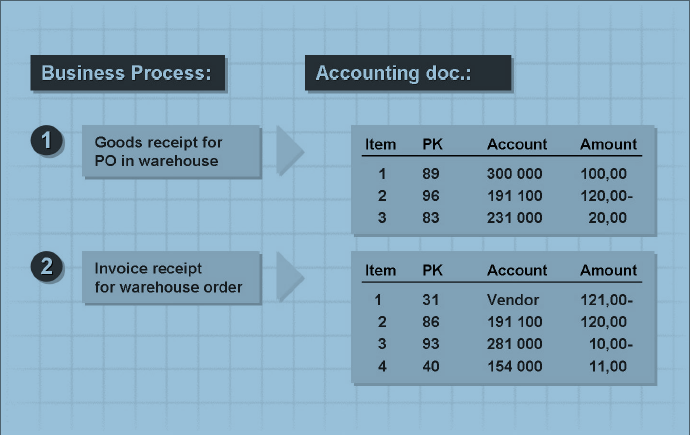

Different transactions in inventory management and invoice verification are relevant to accounting. These transactions must be recorded in an accounting document containing the postings to the FT G/L accounts. The G/L accounts to which the postings are made in such a document should be determined automatically by the program as far as possible.Example:

When a. raw material is issued for a production order, postings are made to stock accounts (under credits) and to consumption accounts (under debits).

in SAP MM process, automatic account determination is a. procedure applied to accounting-relevant transactions. The system uses it to identify the G/L accounts to which postings are to be made without any user intervention. Therefore, these accounts must be entered in a. special table in Customizing for the transactions in inventory management and invoice verification.

|

| Automatic posting for GR and IR with reference to PO |

The figure above is

based on the following SAP MM business processes:

An order was created

with a quantity of 10 pieces at a price of 12 EUR/pc. The material is valued at a standard price of 10 EUR/pc.

In step one on the figure, the goods

receipt is posted: As a result of valuation using

the standard price, the received quantity is posted to stock account 300000 with a value of 100 EUR (10 pc. x 10 EUR standard price).

Since an invoice amount of 120 EUR (10 pc. x 12 EUR purchase

order price) is expected, an offsetting

entry with a value of 120 EUR is made to GRAR clearing account 191100.

The 20

EUR difference between order and valuation price is posted to a price difference account (231000). Since the order price was higher than the valuation price, the price difference is booked as

expenditure.

In step 2 on the

figure, the invoice receipt for the purchase order is posted: The invoice is for 10 pieces at 11 EUR = 110 EL1R, plus 10 % VAT (= 11 SIR), therefore a total of 121

EUR.

This amount is posted to the vendor account (corresponds to the reconciliation account from the master data record).

Since the full quantity that was

delivered is calculated, the GRAR. clearing account 191100 has to be credited with the value from

the goods receipt (=120

EUR).

The invoice value (110 EUR) is lower than the goods receipt value (120 EUR). There is a price

difference again. This time, the actual value is lower than the expected value. Therefore this difference has to be posted to

price difference account 281000 as revenue.

Finally, the tax amount is posted to

account 154000 as input tax.

The posting key (PK column) defines whether a posting is a credit or a

debit and which type of account it is posted

to (debitor or vendor).

|

| Posting Transactions: GR for PO into Warehouse ad for IR |

Above figure shows the typical G/L posting that can occur in he event of a goods receipt into the warehouse or stores or an invoice receipt or a PO item of the category standard without account assignment.

No comments:

Post a Comment